If you’ve done some trading, chances are high you know some things about Forex trading bots already. An Expert advisor or Forex trading bot is an algorithm, a piece of software that automatically trades for you. If you choose well, a bot can help you make a killing in the Forex market but there are also some risks involved. That’s why it’s important to get every bit of information you can on these trading bots before you start to use them. That’s what this guide is about. Here, I’ll start by going over what a Forex trading robot actually is, what risks you take by using it, and how to choose the best bot around. We’ll also take a look at the top 6 candidates for the position of the best Forex trading bot.

If you stick with me to the end, I’m also going to reveal a way to boost the performance and profits of your Forex trading bot. First, let’s go over some basics and definitions, just to make sure we’re on the same page.

What are Forex and Forex trading?

Forex, also called foreign exchange or FX trading, is a trading profession that involves the simultaneous buying and selling of different currencies on the global market. Forex traders, by exchanging one currency for another, aim to gain profits in this actively traded market.

Forex trading market is recognized as the largest and the most liquid financial market in the world, with a daily trading volume of nearly 5 trillion dollars. That is why the number of people who pursue Forex trading is increasing day by day. Consequently, some companies started to develop Forex trading bots to help traders with their Forex exchanges. We will fully talk about these bots in the rest of the article.

Want to Improve your Trading?

Want to Improve your Trading?

Give yourself a better chance at the Forex market by hosting your trading platform right next to your broker.

Get a Forex VPSWhat is Bot Trading?

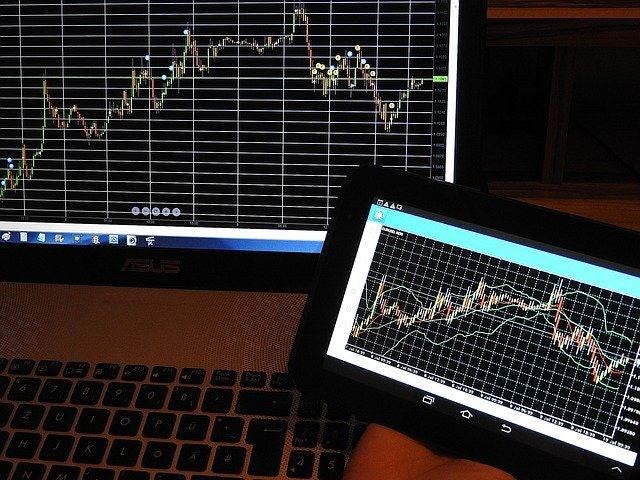

Trading bots are computer programs that identify patterns and automatically conduct trades by using different indicators (they auto-trade). Trading bots first appeared in the foreign exchange trading environment for private investors and soon found their way into the cryptocurrency trading world.

In this new technology, you set the trading bot, and it will make the position along with your setting. They use several indicators and analysis tools to predict the changes in the prices of different currencies, so it is an excellent way to make an effortless and profitable trade. There are different trading strategies that can be applied to a bot. Each strategy has a specific trading goal. You can read all about them in our blog post on the best trading bot strategies

What are Forex trading bots and Forex bot trading?

Forex trading bots, also known as Forex bots, are automated software programs that generate signals of trading similar to other trading bots. Using the MQL scripting language, most of these robots are designed to work with MetaTrader, enabling traders to give trading signals or position orders and manage their trades.

As we stated, these bots can be really advantageous and profit-making for Forex traders which adds up to their high popularity among the traders. In fact, the vast majority of Forex traders, especially the professional experienced ones, use these bots for their Forex bot trading. Here are some of the advantages of using Forex trading robots or Expert Advisors:

- Both experienced and beginner Forex traders can use them

- They analyze the historical data rapidly and accurately

- They don’t act impulsively or emotionally

- They scan for tradable currency pairs and offer them to traders

- They provide 24/7 trading

- Can implement different trading strategies

- Can be combined with Forex VPS to maximize performance

Besides the mentioned advantages, some Forex trading bots, especially the newly developed ones, have their own risks for traders. Being alerted about these kinds of threats is vital for choosing your Forex trading bot.

What are the Risks of Trading with a Forex Bot

Forex trading is a high-risk, high-reward type of investment. However, it can be risky for inexperienced traders. There are some risks that come with trading with a forex bot.

Poorly Performing Algorithms

Perhaps the number one risk every Forex robot trader takes is that of weak algorithms. All Forex trading bots are essentially algorithms, pieces of code created by programmers. As with any piece of software, there are no fixed standards of quality. Just as an AAA game with a budget in millions and a bug-riddled mobile game are both games, so there are plenty of Forex trading robots that only have that name in common. That’s why it’s important to know the Forex bot you choose to run your trading for you.

Flash Crashes

Even Forex trading bots with good algorithms can lead to massive losses for the Forex robot trader in some cases. If you forget to set automatic stop-loss limits and configure your Forex bot with it, it may malfunction and start trading away all your money in a matter of seconds or minutes. That’s where the name Flash Crash comes from. The first time it happened back in 2010, Wall Street had to declare the trades for the whole day invalid because, in under 2 minutes, almost all share values had dropped to zero. In a high-liquidity, high-volatility market like Forex, a Flash Crash is more than risk, it’s almost a sure thing, and more so for those only relying on Forex trading bots.

Scams

This is the case when some Forex bot developers pop up overnight to sell their trading systems with a money-back guarantee and vanish a few weeks later.

The Long Run Ineffectiveness

Another critique of forex trading robots is that they deliver gains in the short term, but their long-term output is mixed. This is largely because they are automated to move and follow patterns within a specific range. As a consequence, in the long run, a sudden price movement will wipe out the profits made.

5 Tips for Finding the Best Forex Trading Bot to Use

As you can see, while Forex bots can provide profitable advantages for your trades, they also come with some hazards that make them cause more harm than good for you. However, if you’re careful in choosing your bots and trading strategies, and run your bots on a powerful Forex VPS like Cloudzy, you’ll have no reason to be overly concerned about these risks.

For this purpose, we invite you to consider the below list in which you can read about some tips that will help you to choose a wise and worthy Forex trading bot for your FX trading. You will surely thank us later.

1. Look for a bot that has a low drawdown rate

Drawdown is a measurement of decline and reduction of the amount of money you can invest (or what they called Risk Capital in Forex). We know that a high drawdown rate can produce higher profits, but they also can make you broke.

2. Look for bots that are thoroughly tested

Before you purchase a Forex bot, you need to view its backtesting first to make sure about its functionality. Just consider the bots that have been backtested.

3. Watch out for reviews from unauthenticated sources

The Forex bot developers only want to sell their products; hence, they will only want you to read the positive reviews about their bots. Plus, people who lost their money due to their own mistakes while using a particular Forex bot tend to give it negative comments. Be aware of these matters and look for reviews from trusted sources, like expert traders or professional reviewers.

4. Purchase a demo account

Before taking any serious decision about your Forex trading bot, purchase a demo account and give it a test. This will help you to see how that particular bot works for you, and as a consequence, you can decide wisely. Look for Forex bot developers who are providing their customers with a demo account.

5. Consider how safe the bot is

Without a doubt, safety comes to the front when it comes to choosing a Forex trading bot by which you want to invest your hard-earned money. Make sure to check out the bot’s website, see if they offer any performance records, and look for social proof of their validity.

Want to Improve your Trading?

Want to Improve your Trading?

Give yourself a better chance at the Forex market by hosting your trading platform right next to your broker.

Get a Forex VPSTop 6 Candidates for the Best Forex Trading Bot 2022

We already covered some of the more significant risks that bot trading Forex can have. A little-known Forex trading robot may promise high pip profits and show you an impressive performance record, but chances are high it’s a scam. This and other risks make it obvious that knowing the best Forex trading bots is crucial. That’s exactly why I’ve compiled this list of the top 6 candidates for the position of the best Forex trading robot. . You can use the tips above to decide which one is the best for you, considering your Forex trading strategy and goals. You can check out each Forex bot’s website by clicking on its name.

GPS Forex Robot is an Expert Advisor (EA) developed by Mark Larsen to help you in marketing decisions. The latest update to the software is GPS Forex Robot 3. This forex robot’s task is to predict short-term market movements with a very high probability so that it brings more profit to you. The reason for naming it GPS Forex Robot is because it is like working similarly to a GPS navigator in a car.

They claim that GPS Forex Robot 3 is accurate in 98% of cases. In the other 2% of cases, it utilizes a reverse trading technique to instantly open a trade in the opposite direction. The purpose of using this reverse trading method is to cover the slight loss. According to their official website, this Forex bot can make more than 30% per month for a private group of forex traders. Moreover, GPS Forex Robot can bring you multiple advantages, including efficiency, reasonable success rate, company transparency, having professional experts helping you in the Forex market, and fair pricing.

Considering all of the pros that a Forex trading bot can deliver you, 1000PipClimber System is a particular tool that offers beginners a way to handle issues in the world of Forex. So by using 1000PipClimber System, newcomers to Forex trading can improve performance and enhance their success in the Forex market. In addition to an intelligent, rules-based System, 1000Pip Climber System provides you with automatic analysis of the Forex market. Even though 1000Pip Climber System is responsible for all the up-front work, it doesn’t give an automated trading service; it simply provides straightforward instructions and guidance that you can. Signals can be sent by push notification, email, or even within the software, making everything more accessible and easier for you.

1000Pip Climber System’s pre-determined rules and easy setup makes it one of the best Forex trading bot in 2022; the algorithm takes over and does all the work for you after you set it up. All you require to do is determine which trades you like to make once you receive the signals from the Forex robot system. 1000Pip Climber System supplies a high-performance solution for Forex robot signal services, allowing for a more focused option than crowded or busy applications and memberships. So, if you like to have simplicity in your Forex trading bot services, 1000Pip Climber System might be the system that suits you the most.

Coinrule is one of the robust Forex trading robot tools available in the current market. It helps you stick to a cryptocurrency strategy without continually staring at your computers as a trader. Unlike many other trading bots, you will not need coding experience to benefit from Coinrule’s features. This Forex robot tool is designed to make trading cryptocurrencies less tiresome; it aims to create an automated trading bot platform to safely set your trading on autopilot mode.

Coinrule claims to offer many benefits for your Forex trading, such as user-friendly automated trading, built-in trading techniques, backtesting opportunities, and support for trustworthy exchanges, assisting you as a Forex bot tool. Therefore, if you don’t have the time or energy to develop and implement trading strategies, Coinrule is a good alternative. Simply because it will implement your strategy for you, and it’s an excellent way to stay an active trader without losing your time. Although, it would be best to be careful as the costs of Coinrule’s paid plans can add up fast. Additionally, you may still need to pay fees to your exchange for every trade that

Forex Gump is an Expert Advisor that primarily functions as a forex trading bot that automatically places and handles trades for you. Please pay attention that you must have it running on your demo or real MT4 trading account. You merely start it and check later to see how it has performed. This Forex robot trader is suitable for both newbie and advanced traders. The Forex Gump uses a variety of trend filters, price action, and a news filter, aiming to deliver the best Forex trading services for you. It includes a high, medium, and low-risk mode to fit your trading preferences. Aside from its pros, There are no backtests on the Forex Gump official website. It would have been helpful for potential users to see 99% modeling quality backtests, giving them an idea of the historical performance.

Forex Trendy is software that helps you avoid trading during uncertain market periods. Instead, it gives you the benefit of picking the best trending pair at the current time. Forex Trendy explores all the charts for you every second, presenting you with the best trending pair and time frame anytime you want. This software runs on our powerful computers, so you instantly get the result online. So, you can use your favorite trading platform, such as MetaTrader, and there is nothing you have to download or install.

Forex Trendy is a sophisticated application capable of recognizing the most reliable continuation chart patterns. Moreover, It goes through all the charts on all time frames and analyzes every potential breakout. Once you sign up for membership, you will have access to various features, including live charts of time frames and top value currency pairs, a summary of the frame trends, email and sound notifications, custom settings in the selection pairs, and automated chart analysis. Forex trading software keeps you updated about the market patterns in a real-time manner, so you will have recommended trades that will result in a higher income. Forex Trendy promises to improve your chances of winning by 70-30 to go beyond breaking even with your capital.

EA Builder is a web-based tool that will enable you to create custom indicators and expert advisors for MetaTrader 4, MetaTrader 5, and TradeStation platforms with just a few clicks. It doesn’t need any download or installation since it is web-based, so all you need is a compatible browser to begin. As a newbie to the market of Forex trading, soon, you will be able to create your custom indicators and forex robots. In addition to the application, you can use a convenient and easy-to-follow user manual that provides you with step-to-step programming examples. A unique part of this manual is a video tutorial that aims to familiarize you with the application and all its features faster.

EA Builder offers a Free version that can fully function for making custom indicators. There is also a paid version of EA Builder capable of creating complex forex trading robots. All beginners to experienced programmers can use this tool as an assistant because it can significantly speed up the development process and create robots for binary options trading.

Comparison table of the best Forex Trading bots

|

Forex trading bot / Features |

Backtesting |

Demo Account |

Pricing |

24/7 technical support |

|

GPS Forex Robot |

|

✅ |

$149 |

Slow |

|

1000pip Climber System |

|

No free trial or Demo version |

$299 |

✅ |

|

Coinrule |

|

✅ |

From $29.99/m To $449.99/m |

✅ |

|

Forex Gump |

No |

✅ |

$4,000 regular account $40 on a micro (cent) account |

✅ |

|

Forex Trendy |

N/A |

N/A |

$250 |

No live customer support |

|

EA Builder |

|

Yes (Fully Working Functionality for Indicator) |

Depends on platform |

No live customer support |

What are cryptocurrency trading bots?

Cryptocurrency trading bots, also called crypto bots, are computer programs that like Forex bots help traders to trade their different cryptocurrencies automatically with an eye on earning profits. Crypto traders can use these bots to have 24\7 trading without missing any chances.

If you want to know more about cryptocurrency trading bots and how do they work, we invite you to read our other knowledge-base article. On this page, we prepared rather a comprehensive article talking about crypto bots and their related topics which is highly recommended to read if you’re interested in the cryptocurrency world.

How does VPS help Forex Trading?

In addition to the Forex trading bot, Forex VPS hosting is another modern technology helping traders to earn themselves profits from the FX market. As it happens, many Forex traders are purchasing and using VPS for Forex bot trading.

Forex VPS services provide traders with a 24\7 uninterrupted attention of the market with no effort from their side. Moreover, by reducing the latency time, a VPS can perform your transactions more efficiently than the computer because your orders will be executed much quicker. Consequently, you will experience less slippage and less delay.

As we all know, slippage costs money, sometimes a lot of money. So, this is a perfect way to decrease your losses and increase your gains. Please note that not all the Forex VPS brokers are this favorable. Obviously, the benefits that different Forex VPS are providing vary from one VPS provider to another.

If you wonder where you should get your Forex VPS from to receive the highest benefits and services, we invite you to read our Top 15 Forex VPS post. We also brought up Cloudzy’s highly beneficial Forex VPS, which is recognized as one of the best in the world and will look at its values in the upcoming section.

How to Boost the Performance of Your Forex Trading Bot

If you’ve read the instructions so far, you’ll have a good chance of choosing a very good Forex trading robot to automate your trading. But even if you get the best Forex bot or Expert Advisor around, its performance and profitability will be limited by the platform it runs on. Simply running a trading platform like MetaTrader on your PC and hoping for the best isn’t going to get you the results you want. Considering the crucial role of latency and slippage in Forex trading, it’s obvious that you need to use a Forex VPS if you want to ensure your Forex trading robots perform well enough to make a real profit.

Then again, not every Forex VPS is going to give your Forex bots the power they need. With 14 servers at the most strategic locations around the globe, Cloudzy’s Forex VPS gives your bots the boost they need by minimizing latency and slippage. More than that, our Forex VPS comes with superior server hardware, including NVMe storage, DDR4 RAM, and 1 Gbps bandwidth. All that power will maximize the efficiency of your Forex trading robots and make sure you have an edge over other traders.

FAQ

What are Forex trading bots?

Forex trading bots or expert advisors are AI-based algorithms that automate your Forex trading by buying or selling according to the market.

Are Forex trading robots safe to use?

In a word, yes. However, there are some risks associated with automated trading, which I’ve mentioned above.

Are Forex trading bots free or do I need to pay for them?

As with most applications, there are both free and commercial Forex bots around. While there may be a few good trading bots available for free, it’s generally better to go with a commercial option. You usually need to pay a monthly subscription fee to use them.

![How to Make a Modded Minecraft Server? 👾 [2024 Guide]](https://cloudzy.com/wp-content/uploads/How-to-Host-a-Modded-Minecraft-Server-1-420x234.png)

Automated trading can be a profitable bonus skill, but it is usually not available online for a few dollars. Automated trading requires a lot of work and skills. In order to effectively create and maintain EAs, traders need trading and programming skills.

In it something is. Clearly, I thank for the information.

I want to know how much exactly will using vps affect on my trading process?

You essentially need to use a VPS if you’re using software to automate and execute forex trades. That isn’t you physically hitting ‘buy’ or ‘sell,’ but this is a machine doing the hard work for you! Success in the Forex trade market relies heavily on market times, reliable trading systems, and strong internet connections

Thank you so much for taking your time to read our blog 🌻

I suggest everyone to start using a VPS for their forex trading. I bet you will see the difference😉

Bots have helped me grow my trading to a much more professional level

Thanks for this complete article I had no vision about this topic

To increase your convenience and fast setup, RouterHosting offers its plan to trading live on Forex VPS platforms. There’s no “one size fits all” approach with VPS Servers; instead, they provide standard as well as optimized packages that can suit your budget and needs. I am using Router’s VPS now and I suggest you try their service

There are a lot of uses for VPS and the best of them to me is the help it provides for forex trading

I could never trust bot trading but I am using VPS for trading since I want to do my trading with a foreign location IP address and it is really helpful

I don’t know why some people are against bots, but with the right VPS service and bots you are good to go

Well with a little bit of research and experience in working with trader bots I can tell you they are more than great. They help you make your purchase at the correct time

I just finished reading this post. Now i think i should try this forex bot trading that you explained.

I thin you should add Auto ARB and Centobot to the list of best forex trading bot in your article. I used both of them for my forex exchanges and they really worked for me.

Really? I didnt know that i can use vps for bot trading. Thank you for this informative article